Paper contracts can take weeks to travel around the globe, while digital documents are uncomfortably easy to forge. Is there a way to automate transactions to make them smoother, more efficient, and more secure for all parties? Leaders are looking at blockchain and smart contracts as a viable solution.

Blockchain technology is generating significant interest across a wide range of industries. As the field of applications for blockchains grows, industry leaders are customizing and tailoring the technology to fit very particular uses. Blockchain-based smart contracts—self-executing code on a blockchain that automatically implements the terms of an agreement between parties—are a critical step forward, streamlining processes that are currently spread across multiple databases and ERP systems. Smart contracts in the commercial realm have not yet been proven, but we believe that permissioned blockchains (those that are privately maintained by a small group of parties) in particular will find near-term adoption. Two blockchain-based smart contract use cases—(1) securities trade clearing and settlement and (2) supply chain and trade finance document handling—carry important lessons for business and technology leaders interested in smart contract applications.

SIGNALS

Smart contract VC-related deals totaled $116 million in Q1 of 2016, more than twice as much as the prior three quarters combined and accounting for 86 percent of total blockchain venture funding

An Ethereum-based organization has raised over $150 million to experiment with and develop smart contract-driven applications.

- The Australian Securities Exchange is developing a blockchain-based post-trade solution to replace its current system

- The Post-Trade Distributed Ledger Group, an organization launched to explore post-trade applications on the blockchain, has 37 financial institutions as members

- Five global banks are building proof-of-concept systems with a trade finance and supply chain platform that uses smart contracts

- Barclays Corporate Bank plans to leverage a smart contract bill-of-lading platform to help its clients reduce supply chain management costs

- The state of Delaware announced initiatives to utilize smart contracts for state-recognized “distributed ledger shares” and to streamline back-office procedures

WHAT ARE BLOCKCHAIN-BASED SMART CONTRACTS?

Smart contracts represent a next step in the progression of blockchains from a financial transaction protocol to an all-purpose utility. They are pieces of software, not contracts in the legal sense, that extend blockchains’ utility from simply keeping a record of financial transaction entries to automatically implementing terms of multiparty agreements. Smart contracts are executed by a computer network that uses consensus protocols to agree upon the sequence of actions resulting from the contract’s code. The result is a method by which parties can agree upon terms and trust that they will be executed automatically, with reduced risk of error or manipulation.

Technology leaders envision many applications for blockchain-based smart contracts, from validating loan eligibility to executing transfer pricing agreements between subsidiaries. Importantly, before blockchain this type of smart contract was impossible because parties to an agreement of this sort would maintain separate databases. With a shared database running a blockchain protocol, the smart contracts auto-execute, and all parties validate the outcome instantaneously and without need for a third-party intermediary.

But when should companies employ blockchain-enabled smart contracts rather than existing technology? They can be a worthwhile option where frequent transactions occur among a network of parties, and manual or duplicative tasks are performed by counterparties for each transaction. The blockchain acts as a shared database to provide a secure, single source of truth, and smart contracts automate approvals, calculations, and other transacting activities that are prone to lag and error.

BLOCKCHAIN-BASED SMART CONTRACT BENEFITS

For a wide range of potential applications, blockchain-based smart contracts could offer a number of benefits:

Speed and real-time updates. Because smart contracts use software code to automate tasks that are typically accomplished through manual means, they can increase the speed of a wide variety of business processes.

Accuracy. Automated transactions are not only faster but less prone to manual error.

Lower execution risk. The decentralized process of execution virtually eliminates the risk of manipulation, nonperformance, or errors, since execution is managed automatically by the network rather than an individual party.

Fewer intermediaries. Smart contracts can reduce or eliminate reliance on third-party intermediaries that provide “trust” services such as escrow between counterparties.

Lower cost. New processes enabled by smart contracts require less human intervention and fewer intermediaries and will therefore reduce costs.

New business or operational models. Because smart contracts provide a low-cost way of ensuring that the transactions are reliably performed as agreed upon, they will enable new kinds of businesses, from peer-to-peer renewable energy trading to automated access to vehicles and storage units.

SMART CONTRACT USE CASES

To determine high-impact areas of potential, Deloitte’s analysis of smart contract use cases considered a number of factors, including: a sizable market opportunity; the presence of active, relatively well-funded start-ups targeting the opportunity; the participation of prominent investors; technical feasibility and ease of implementation; and evidence of multiple pilots or adoption by corporations. The lowest-hanging fruits today are applications in which contracts are narrow, objective, and mechanical, with straightforward clauses and clearly defined outcomes.

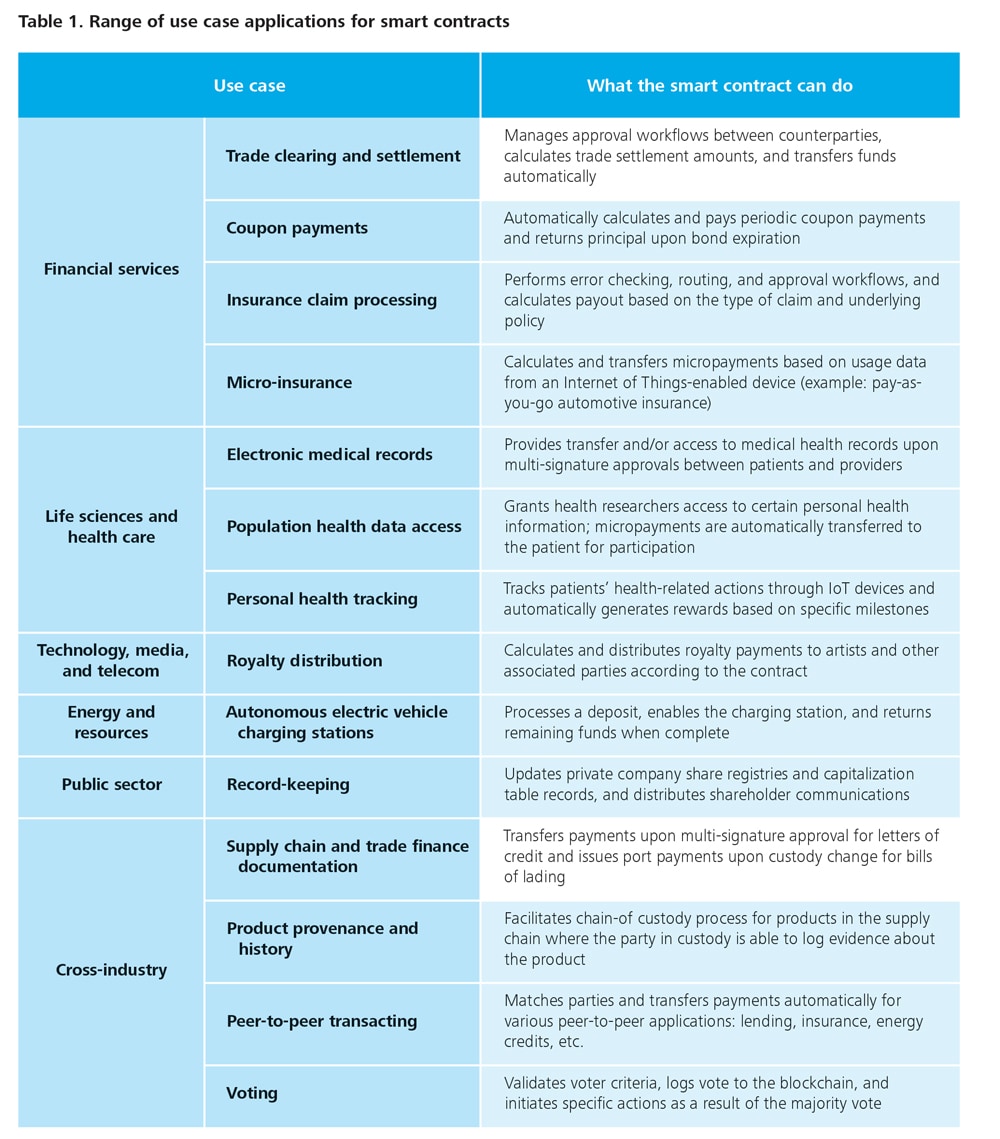

We have identified a range of applications—ranging from smart health records to pay-as-you-go insurance—that companies are piloting right now (see table). Using the criteria above, two use cases stand out for their immediacy to market: trade clearing and settlement and supply chain and trade finance.

Trade clearing and settlement

Blockchains provide a single ledger as the source of truth, and smart contracts offer the ability to automate approval workflows and clearing calculations that are prone to lag and error—thus reducing errors, cost, and the time to settlement. Trade clearing and settlement often entails labor-intensive activities that include various approvals and/or complex internal and external reconciliations. Banks maintain substantial IT networks, but independent processing by each counterparty causes discrepancies that lead to costly resolutions and settlement delays.

The opportunity to streamline clearing and settlement processes with the blockchain and smart contracts is immense. In 2015, the Depository Trust & Clearing Corp. (DTCC) processed over $1.5 quadrillion worth of securities, representing 345 million transactions. Santander Bank’s innovation fund, Santander Innoventures, expects blockchain technology to lead to $15–20 billion in annual savings in infrastructure costs by 2022. Seven start-ups, retaining funding of over $125 million, have platforms or services targeting this space: The list of more than 35 investors behind these companies is equally impressive; it includes not only major venture funds such as Khosla Ventures and SV Angel but also large banks such as Citigroup, JP Morgan, and Santander, and other organizations such as NASDAQ and the DTCC itself.

Wall Street has also been busy exploring this space. More than 40 global banks within the R3 consortium participated in testing that included clearing and settlement activity, and many of those banks have pursued further trials individually. The Australian Securities Exchange is also working on a smart contracts-based post-trade platform to replace its equity settlement system, and four global banks and the DTCC recently ran a successful trial of a smart contracts solution for post-trade credit default swaps.

Supply chain and trade finance documentation

Blockchains can make supply chain and trade finance documentation more efficient, by streamlining processes previously spread across multiple parties and databases on a single shared ledger. All too often, supply chains are hampered by paper-based systems reliant on trading parties and banks around the world physically transferring documents, a process that can take weeks for a single transaction. Letters of credit and bills of lading must be signed and referenced by a multitude of parties, increasing exposure to loss and fraud. Current technologies haven’t addressed this issue because digital documents are easy to forge; even current IT systems at banks simply track the logistics of physical documents for trade finance. A blockchain can provide secure, accessible digital versions to all parties in a transaction, and smart contracts can be used to manage the workflow of approvals and automatically transfer payment upon all signatures being collected.

Because current paper systems drive $18 trillion in transactions per year, there’s an attractive opportunity to decrease costs and improve reliability in supply chain and trade finance. Four start-ups have emerged in this area, all of which have noted engagement with banks in proof-of-concept activities. Funding has not been disclosed, but backers include three respected venture funds in addition to Barclays.

A number of corporations have also shown mounting interest in this area. Seven banks have revealed proof-of-concept testing, and the numbers noted by start-ups indicate more that haven’t been publicly revealed. One start-up in particular noted implementation roadmaps with five banks as well as a major insurer. Barclays Corporate Bank recently partnered with one of the start-ups, Wave, a platform that stores bill-of-lading documents in the blockchain and uses smart contracts to log change of ownership and automatically transfer payments to ports upon arrival. Bank of America, Standard Charter, and the Development Bank of Singapore are also among the banks pursuing proof-of-concepts of their own.

WHAT TO WATCH

Smart contract technology is still in its early stages. Business and technology leaders who want to stay current on implications of smart contracts should track both technology and business developments surrounding smart contracts.

On the technology side, certain advances will help broaden the applications and adoption of smart contracts.

Scalability. Smart contract platforms are still considered unproven in terms of scalability.

External information. Because smart contracts can reference only information on the blockchain, trustworthy data services—known as “oracles”—that can push information to the blockchain will be needed. Approaches for creating oracles are still emerging.

Real assets. Use cases that effectively link smart contracts to real assets are still in their infancy.

Flexibility. The immutability of blockchain-based smart contracts today means that developers must anticipate any conceivable scenario necessitating changes to the contract.

Privacy. The code within smart contracts is visible to all parties within the network, which may not be acceptable for some applications.

Latency. Blockchains suffer from high latency, given that time passes for each verified block of transactions to be added to the ledger. For Ethereum, the most popular blockchain for smart contracts, this occurs approximately every 17 seconds—a far cry from the milliseconds to which we are accustomed while using non-blockchain databases.

Permissioning. While excitement for smart contracts is growing in the realm of both permission-less and permissioned blockchains, the latter is likely to see faster adoption in industry, given that complexities around trust, privacy, and scalability are more easily resolved within a consortium of known parties.

Watch for major trials or deployments that achieve new milestones in scalability, or technologies that successfully address issues of privacy or enable greater trust of oracles. These are key signs of maturity, signaling that smart contracts are positioned for wider adoption.

On the business side, new capabilities and business models that extend beyond the digital realm driven by smart contracts will emerge in the coming months. For instance, start-ups have already paired smart contracts with IoT devices to provide access via smart locks or automatically enable electric vehicle charging stations. Pushing IoT sensor data to the blockchain will also open up countless possibilities; among them, look for new business models that are based on usage rather than time, and applications that employ micropayments automatically.

Revised legislation that accomodates smart contracts or recognition of smart contracts by legal authorities will also be critical for some applications of smart contracts. This will be another signal to watch for that indicates the technology is positioned for wider adoption.

CONSIDERATIONS FOR CORPORATIONS

Business leaders who may not be closely following blockchain developments should consider examining the technology and evaluate how it can be paired with smart contracts to drive efficiencies or new business capabilities.

Operations executives should look to their own processes to evaluate where smart contracts may be applicable. Some factors to look for include complex and manual work flows, multiparty agreements, lack of trust between parties, and interdependent transactions. Likewise, ideating on new capabilities that could be made possible by smart contracts should be considered in the context of current strategy or innovation efforts.

Given that smart contracts represent a new model of computing, software development teams and IT leaders should consider exploring the implications of this approach. Implementing smart contracts on a blockchain will require significant integration work, and it will be important to understand the new protocols and considerations when evaluating these applications for the enterprise.

Invest in Ethereum on eToro the World's Top Social Trading Network!

ReplyDeleteJoin millions who have already discovered better methods for investing in Ethereum.

Learn from profitable eToro traders or copy their positions automatically!

ayam bangkok magon super

ReplyDeleteayam bangkok super terbaru

ReplyDeleteI want to thank you for this excellent read, and I've bookmarked your site to look at future posts of yours. I appreciate you giving such a piece of helpful information, and I will save and return it to your website. Keep sharing about Smart Contract.

ReplyDelete